New Jersey Wage Calculator

Calculate your hourly, daily, weekly, monthly, and annual wages with NJ tax considerations

Wage Calculator

Tax Information (Optional)

Results

Enter your wage information and click calculate to see results

NJ Quick Facts 2025

Multiple Calculations

Hourly, daily, weekly, monthly, and annual wages

Tax Estimates

NJ state and federal tax calculations

Mobile Friendly

Responsive design for all devices

Instant Results

Real-time calculations as you type

Tax rates and information are estimates based on 2025 tax brackets.

Always consult with a tax professional for accurate tax planning.

What is the New Jersey Wage Calculator?

The New Jersey Wage Calculator is a sophisticated digital tool designed to help employees and employers accurately estimate take-home pay after accounting for federal taxes, New Jersey state taxes, and other mandatory deductions. This calculator provides comprehensive calculations for hourly, daily, weekly, monthly, and annual wages, specifically tailored to New Jersey’s unique tax structure and deduction requirements. Unlike generic paycheck calculators, this tool incorporates New Jersey-specific tax brackets, disability insurance rates, and family leave contributions to deliver personalized financial insights.

For New Jersey residents, understanding your complete compensation picture is crucial due to the state’s progressive income tax system (ranging from 1.40% to 10.75%), additional payroll taxes, and local tax considerations that impact your net income. This calculator eliminates the guesswork from paycheck calculations, helping you make informed financial decisions, plan your budget effectively, and understand exactly how much of your earnings go toward various taxes and deductions.

How to Use the New Jersey Wage Calculator

1. Select Your Input Method: Choose how you want to enter your compensation, whether by hourly rate, daily rate, weekly rate, or annual salary. The calculator will automatically adjust the other fields based on your selection.

2. Enter Your Wage Information: Input your gross wage amount in the selected field. If you choose hourly or daily rate, you’ll need to specify your typical hours per week and days worked per week. The calculator defaults to a standard 40-hour workweek with 5 working days, but you can customize these values to match your actual work schedule.

3. Adjust Time Parameters: Modify the weeks per year field if you work something other than a standard 52-week year. This is particularly important for seasonal workers, teachers, or contractors with irregular work schedules.

4. Provide Tax Information (Optional): For more accurate results, select your filing status (single, married filing jointly, married filing separately, or head of household) and indicate any allowances you claim on your NJ-W4 form. This information helps the calculator apply the correct tax brackets and deductions.

5. Review and Calculate: Click the calculate button to generate comprehensive results. The calculator will display both your gross income (before taxes) and net income (after taxes) across all time periods, along with a detailed breakdown of all deductions.

*Pro Tip: For the most accurate results, have your most recent pay stub and NJ-W4 form handy to reference your exact tax withholding selections.*

⚙️ How the Calculator Works: The Formulas Behind the Results

The New Jersey Wage Calculator uses mathematical formulas and up-to-date tax regulations to compute your take-home pay. Here’s an inside look at the calculations happening behind the scenes:

Gross Income Calculations

The calculator first determines your gross annual income based on your input method:

● From Hourly: Annual Gross = Hourly Rate × Hours per Week × Weeks per Year

● From Daily: Annual Gross = Daily Rate × Days per Week × Weeks per Year

● From Weekly: Annual Gross = Weekly Rate × Weeks per Year

● From Annual: Annual Gross = Annual Salary

The calculator then derives all other gross income figures (monthly, weekly, daily, hourly) from this annual gross amount.

Tax Calculation Formulas

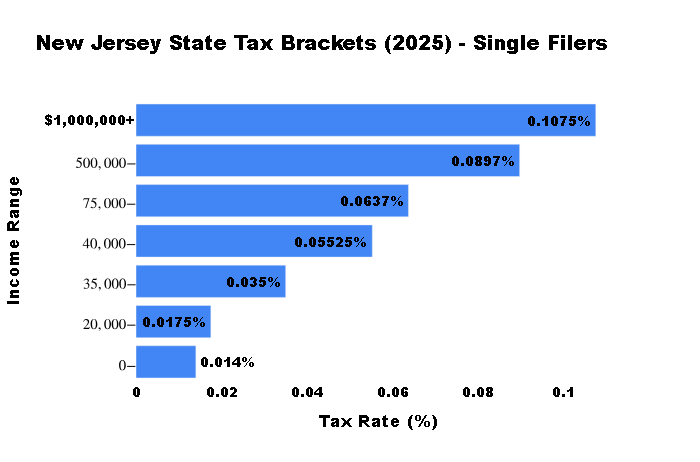

The calculator applies New Jersey’s progressive tax system using 2025 tax brackets:

| Taxable Income Bracket (Single Filer) | Tax Rate |

|---|---|

| $0 – $20,000 | 1.40% |

| $20,000 – $35,000 | 1.75% |

| $35,000 – $40,000 | 3.50% |

| $40,000 – $75,000 | 5.525% |

| $75,000 – $500,000 | 6.370% |

| $500,000 – $1,000,000 | 8.970% |

| $1,000,000+ | 10.750% |

Note: Brackets differ slightly for married filing jointly, married filing separately, and head of household statuses.

The calculator also incorporates these critical deductions:

- ● Federal Insurance Contributions Act (FICA) Taxes:

- • Social Security Tax: 6.2% on income up to $147,000.

- • Medicare Tax: 1.45% on all earnings (plus 0.9% additional Medicare tax on income over $200,000 for single filers).

- ● New Jersey-Specific Deductions:

- • State Disability Insurance (SDI): 0.47% of wages.

- • Family Leave Insurance (FLI): Variable rate based on current NJ regulations.

- • Unemployment Insurance: Employee contribution (if applicable).

- ● Federal Income Tax: Calculated using IRS tax brackets based on your filing status and income level.

Net Income Calculation

The final take-home pay is calculated using this formula:

Net Annual Income = Gross Annual Income – (Federal Income Tax + NJ State Tax + Social Security Tax + Medicare Tax + NJ SDI + NJ FLI + Other Deductions)

The calculator then breaks this annual net amount down into monthly, weekly, daily, and hourly net income figures.

Understanding New Jersey’s Tax Structure

New Jersey’s tax system has several unique characteristics that make accurate paycheck calculations essential:

Progressive Income Tax

New Jersey employs a graduated income tax system with rates ranging from 1.40% to 10.75%, depending on your income level and filing status. Unlike states with a flat tax rate, this means higher earners pay a progressively higher percentage of their income in state taxes.

Local Taxes

While some states have local income taxes, New Jersey does not allow municipalities to levy local income taxes 4. However, Newark imposes a 1% payroll tax on employers (not directly on employees). This simplification means your New Jersey tax calculation is based solely on state-level taxes regardless of which municipality you live or work in.

Mandatory Insurance Programs

New Jersey requires participation in several insurance programs that impact your paycheck:

- ● State Disability Insurance (SDI): Provides benefits for non-work-related illnesses or injuries. Funded through employee contributions.

- ● Family Leave Insurance (FLI): Provides benefits to care for a family member or bond with a new child. Also funded through employee deductions.

- ● Unemployment Insurance: Primarily employer-funded, but employees may contribute in certain circumstances.

Why This Calculator Is Essential for New Jersey Residents

Accurate paycheck calculations are particularly valuable for:

- ● Job Offer Evaluations: Compare compensation packages between New Jersey and other states, or between different employers within New Jersey.

- ● Budget Planning: Understand your exact take-home pay to create realistic budgets and financial plans.

- ● Tax Withholding Optimization: Determine if you need to adjust your W-4 or NJ-W4 withholdings to avoid large tax bills or excessive refunds.

- ● Overtime Decision Making: Calculate the true net value of working extra hours after accounting for tax implications.

- ● Side Income Evaluation: Understand the net benefit of taking on additional work or freelance opportunities.

Considerations

While the New Jersey Wage Calculator provides highly accurate estimates, users should be aware of these considerations:

- 1. Pre-Tax Deductions: The calculator may not account for all pre-tax deductions (health insurance, retirement contributions, etc.) that would further reduce taxable income.

- 2. Tax Law Changes: Tax rates and brackets are subject to legislative changes. The calculator uses current 2025 rates.

- 3. Bonus Payments: Bonus income is typically taxed at different rates than regular wages 7.

- 4. Multi-State Situations: Those who live or work in multiple states may have more complex tax situations that require professional consultation.

- 5. Tax Credits: The calculator doesn’t incorporate potential tax credits you might qualify for when filing your annual return.

For precise tax planning or complex financial situations, always consult with a qualified tax professional who can account for your complete financial picture.

Use the New Jersey Wage Calculator regularly to stay informed about your finances and maximize your take-home pay in the Garden State!