🏠 Land Loan Payment Calculator

Calculate your land loan payments with precision. Get instant results for monthly payments, total interest, and complete breakdown.

🏡 Loan Details

⚙️ Additional Costs

What is a Land Loan Payment Calculator?

A Land Loan Payment Calculator is a specialized financial tool designed to help potential landowners estimate their monthly payments and total costs when financing a land purchase. Unlike standard mortgage calculators, land loan calculators account for the unique characteristics of land financing, which typically feature higher interest rates, larger down payment requirements, and shorter loan terms.

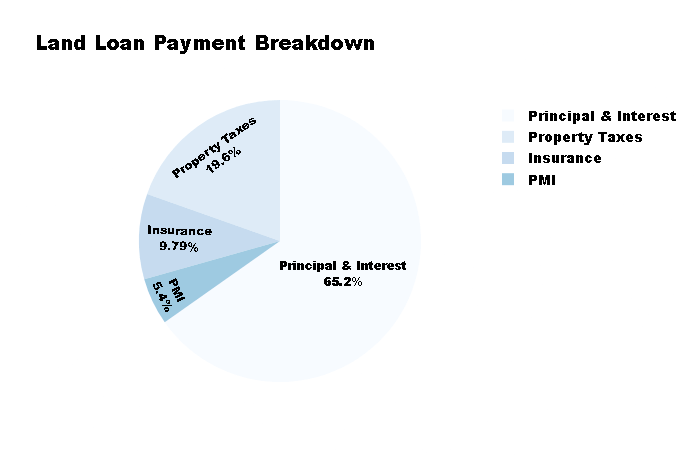

Our calculator provides a comprehensive analysis of your potential land loan, breaking down monthly payments into principal, interest, property taxes, insurance, and any additional fees. It helps you understand the full financial commitment of purchasing land before you make an offer.

How to Use Our Land Loan Payment Calculator

1. Enter Loan Details: Input the purchase price of the land, your planned down payment (either as a dollar amount or percentage), the anticipated interest rate, and the loan term in years.

2. Add Additional Costs: Include annual property taxes, insurance costs, Private Mortgage Insurance (PMI if applicable), and any loan application fees.

3. Calculate: Click the “Calculate Payment” button to generate instant results.

4. Review Results: Examine your monthly payment breakdown, total interest costs, and complete loan summary to make an informed decision.

How Our Land Loan Calculator Works

Principal and Interest Calculation

The core calculation uses the standard amortization formula:

M = P × (r(1+r)^n) / ((1+r)^n – 1)

Where:

• M = Monthly payment

• P = Loan principal (purchase price minus down payment)

• r = Monthly interest rate (annual rate divided by 12)

• n = Total number of payments (loan term in years multiplied by 12)

Additional Cost Calculations

● Property Taxes: Annual taxes divided by 12 for monthly amount

● Insurance: Annual premium divided by 12 for monthly cost

● PMI: Typically required if down payment is less than 20% of land value

● Fees: One-time costs divided across the loan term (optional)

Total Cost Analysis

The calculator sums all components to provide:

● Monthly payment breakdown

● Total interest paid over the loan life

● Complete cost of land ownership

● Comparison of different down payment scenarios

Key Features of Our Land Loan Calculator

- ● Real-time Synchronization.

- ● Comprehensive Breakdown.

- ● Completely Free to Use.

- ● No Registration Required.

- ● Privacy-Focused: Your financial data never leaves your browser.

Land Loans

Land loans differ significantly from traditional mortgages in several ways:

1. Higher Down Payments

Most lenders require 20-50% down payment for raw land, compared to 3-20% for traditional homes.

2. Shorter Terms

Land loans typically have shorter repayment periods (5-20 years) versus standard 30-year mortgages.

3. Higher Interest Rates

Interest rates for land loans are generally 1-3 percentage points higher than conventional mortgages.

4. Land Classification Matters

Lenders categorize land differently, which affects loan terms:

- ● Raw Land: No utilities, roads, or improvements (highest rates).

- ● Unimproved Land: Some basic utilities but not build-ready.

- ● Improved Land: Utilities and road access available (best rates).

FAQ

Q: How much down payment is typically required for a land loan?

A: Most lenders require 20-50% down payment for land loans, depending on the land type and intended use.

Q: Can I include construction costs in my land loan?

A: Some lenders offer land-to-construction loans, but these have different requirements than standard land loans.

Q: Are interest rates higher for land loans?

A: Yes, land loans typically have higher interest rates than traditional mortgages due to the higher risk for lenders.

Q: How does raw land differ from improved land in lending terms?

A: Raw land (without utilities or road access) typically requires larger down payments and commands higher interest rates than improved land.

Q: Can I use a land loan for agricultural purposes?

A: Specialized agricultural lenders may offer better terms for farmland purchases than conventional land loans.