Emergency Fund Calculator

Plan your financial safety net with our comprehensive calculator

Calculator Settings

Include rent, food, utilities, insurance, etc.

Your Emergency Fund Plan

Target Amount

$30,000

Still Needed

$20,000

Time to Goal

40 months

Current Progress

33%

💡 Recommendations

- • Consider increasing monthly savings to reach your goal faster

- • Keep emergency funds in a high-yield savings account

- • Review and update your emergency fund target annually

Emergency Fund Guidelines

3-6 Months

Recommended for stable employment and dual-income households

6-9 Months

Ideal for single income or variable income situations

9-12 Months

Conservative approach for maximum security

What is an Emergency Fund Calculator?

An emergency fund calculator is a specialized digital tool designed to help individuals determine the optimal amount of money they should set aside to cover unexpected financial emergencies. This calculator considers various personal financial factors such as monthly expenses, income stability, existing savings, and individual risk tolerance to provide a tailored savings goal.

Unlike generic rules of thumb (e.g., “save 3-6 months of expenses”), a well-designed calculator offers personalized recommendations based on your unique financial situation, helping you build a robust financial safety net against unforeseen events like job loss, medical emergencies, or major repairs.

Financial experts consistently emphasize that having liquid assets for emergencies is the foundation of financial security. Without this safety net, unexpected expenses often lead to high-interest debt or financial instability. Our calculator goes beyond basic calculations by providing actionable insights and personalized strategies to help you achieve your financial security goals efficiently.

How to Use Our Emergency Fund Calculator

1. Enter Monthly Living Expenses: Input your total essential monthly costs, including housing, utilities, groceries, insurance, transportation, and other necessary expenditures. Be thorough and realistic here, underestimating will leave you underprepared for actual emergencies.

2. Select Your Target Timeline: Choose how many months of expenses you want to cover. The calculator offers preset buttons (3, 6, 9, or 12 months) or a custom input field.

3. Input Current Savings: Enter the amount you’ve already saved specifically for emergencies. This helps the calculator determine how much additional saving you need.

4. Add Monthly Contribution: Specify how much you can comfortably set aside each month toward your emergency fund. Even small amounts add up significantly over time due to compound interest.

5. Calculate and Review Results: Click the calculate button to receive instant, personalized results including your target fund amount, progress visualization, time-to-goal estimation, and customized recommendations.

Pro Tip: Revisit the calculator annually or whenever your financial situation changes (job change, marriage, new dependents) to keep your emergency fund target aligned with your current needs.

⚙️ How Our Emergency Fund Calculator Works

Behind the Scenes: The Algorithm

Our calculator employs a sophisticated algorithm that goes beyond simple multiplication. While the core calculation is based on multiplying your monthly expenses by your target months, it also incorporates advanced financial modeling to provide truly personalized recommendations:

mathematical

Target Emergency Fund = Monthly Essential Expenses × Target Months

Additional Savings Needed = Target Emergency Fund - Current Savings

Time to Goal (months) = Additional Savings Needed / Monthly Contribution

The calculator also factors in hidden considerations that many basic tools overlook:

- ● Income stability: Those with variable income (freelancers, commission-based workers) receive suggestions for larger buffers.

- ● Family size: More dependents typically mean higher recommended targets.

- ● Economic factors: The algorithm considers current economic conditions and inflation trends.

- ● Financial obligations: High debt loads may warrant more conservative recommendations.

Emergency Fund Guidelines: How Much Should You Really Save?

While each person’s situation is unique, these research-based guidelines can help you determine an appropriate target:

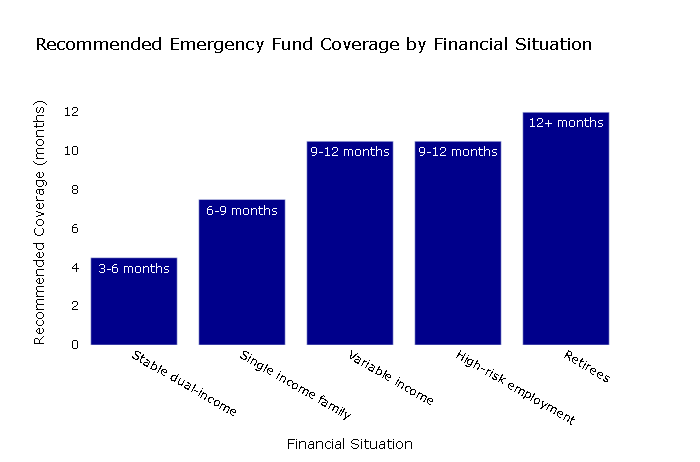

| Financial Situation | Recommended Coverage | Special Considerations |

|---|---|---|

| Stable dual-income | 3-6 months | Minimum protection for secure households |

| Single income family | 6-9 months | Buffer for single earner vulnerability |

| Variable income | 9-12 months | Protection against income fluctuations |

| High-risk employment | 9-12 months | Extended coverage for uncertain job markets |

| Retirees | 12+ months | Additional healthcare and market risk protection |

These guidelines are based on research from leading financial institutions and experts who analyze economic trends, employment data, and emergency spending patterns.

Where to Keep Your Emergency Fund

Liquidity and safety are the primary considerations when choosing where to store your emergency fund. The calculator provides guidance on optimal placement:

- ● High-yield savings accounts: Offer better interest rates than traditional savings while maintaining FDIC insurance and immediate access.

- ● Money market accounts: Provide check-writing privileges with slightly higher yields.

- ● Short-term certificates of deposit (CDs): For portions of your fund you won’t need immediately, offering higher returns while still maintaining safety.

Avoid investing emergency funds in stocks, cryptocurrencies, or other volatile instruments—the potential for loss contradicts the purpose of emergency savings.

Strategies to Build Your Emergency Fund Faster

Our calculator provides personalized recommendations based on your specific situation, but these proven strategies can help accelerate your progress:

- 1. Automate your savings: Set up automatic transfers from checking to savings immediately after each paycheck arrives. This “pay yourself first” approach ensures consistency.

- 2. Redirect windfalls: Direct tax refunds, bonuses, gifts, and unexpected income directly to your emergency fund.

- 3. Implement a spending freeze: Designate periods where you avoid non-essential spending and redirect those amounts to savings.

- 4. Progressively increase contributions: Gradually raise your monthly savings rate by 1% every few months—small increases are less noticeable but add up significantly.

- 5. Apply found money: Use cashback rewards, side hustle income, or saved money from canceled subscriptions to boost your emergency fund.

- 6. Bank your savings: When you pay off a debt, continue making the same monthly payment to your emergency fund .

FAQ

How often should I revisit my emergency fund target?

A: Review your emergency fund at least annually or whenever you experience a major life change (marriage, divorce, new child, job change, home purchase). Significant changes in expenses or income should trigger an immediate recalculation.

Can I invest my emergency fund for higher returns?

A: Not recommended. Emergency funds should be kept in safe, liquid accounts despite lower returns. The primary purpose is financial protection, not growth. Consider separating your emergency fund from investment accounts once you’ve established basic financial security.

What constitutes a true financial emergency?

A: True emergencies are unexpected, necessary, and urgent expenses. Examples include job loss, medical emergencies, essential home repairs, or critical car repairs. Non-essentials like vacations, electronics upgrades, or entertainment don’t qualify.

Should I pay off debt or build an emergency fund first?

A: Both are important. Most experts recommend building a small emergency fund ($1,000-2,000) while tackling high-interest debt, then focusing on building a full emergency fund once expensive debt is eliminated.