Free 50-30-20 Budget Calculator

Master your finances with the proven 50-30-20 budgeting rule

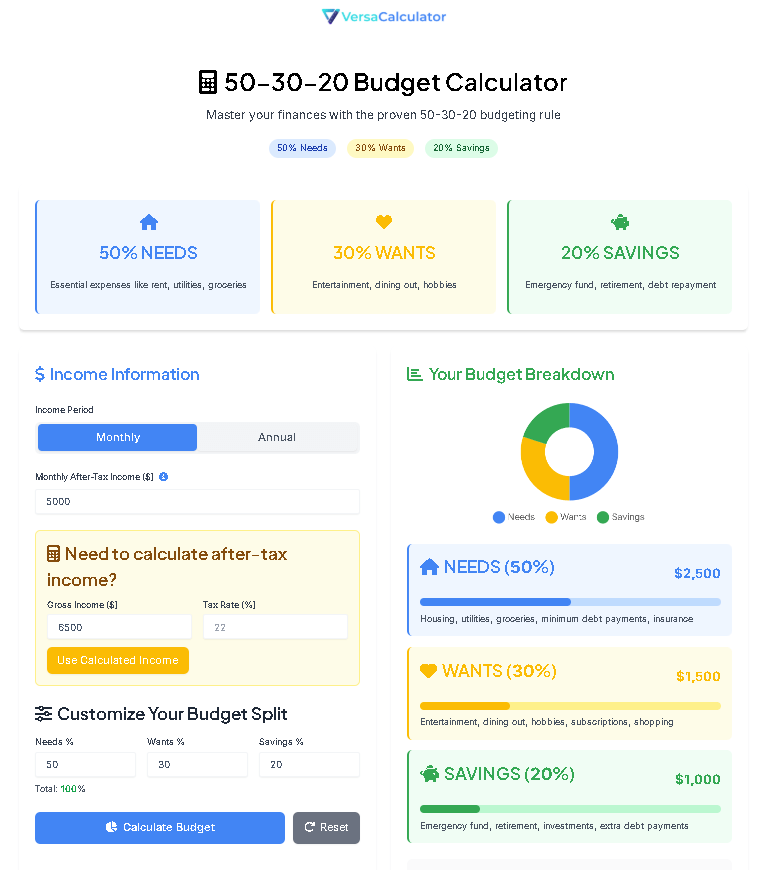

50% NEEDS

Essential expenses like rent, utilities, groceries

30% WANTS

Entertainment, dining out, hobbies

20% SAVINGS

Emergency fund, retirement, debt repayment

Income Information

Need to calculate after-tax income?

Customize Your Budget Split

Your Budget Breakdown

NEEDS (50%)

$2,500WANTS (30%)

$1,500SAVINGS (20%)

$1,000Annual Projections

Enter your income to see your budget breakdown

Personalized Tips & Recommendations

Smart Money Tips

Emergency Fund Goal

How to Use Our 50/30/20 Budget Calculator

1. Enter Your Income: Input your monthly after-tax income (take-home pay). If you know your gross income, use our built-in tax calculator to estimate your net income.

2. Customize Percentages (Optional): While 50/30/20 is the default, adjust the splits to match your goals (e.g., increase savings to 25%).

3. Click Calculate: Instantly see your monthly and annual allocations across all three categories.

4. Review Visual Breakdown: Analyze the color-coded chart and progress bars to understand your money distribution.

5. Set Emergency Fund Goals: Use the integrated emergency fund calculator to determine your target savings based on your needs category.

Formulas Behind the Calculator

● Monthly Needs Allocation: Monthly Income × 0.5 (or custom percentage)

● Monthly Wants Allocation: Monthly Income × 0.3 (or custom percentage)

● Monthly Savings/Debt Allocation: Monthly Income × 0.2 (or custom percentage)

● Annual Projections: Monthly allocation × 12

● Emergency Fund Target: Monthly Needs × Number of Months (typically 3-6)

Is the 50/30/20 rule realistic for low incomes?

Yes, but may require adjustments. Those with lower incomes often have a higher percentage going to needs. The framework still helps prioritize limited resources.

🧮 Advanced Calculation: Incorporating Tax Planning

● Federal and state income taxes

● Social Security and Medicare taxes

● Health insurance premiums

● Retirement plan contributions

● Other payroll deductions

Implementing Your 50/30/20 Budget: Practical Strategies

Automating Your Financial Plan

Set up systematic transfers that align with your pay schedule:

- Direct deposit splitting into multiple accounts

- Automatic transfers to savings and investment accounts

- Bill pay systems for regular expenses

Tracking and Adjustment Techniques

- Weekly check-ins to monitor category spending

- Monthly reviews to assess alignment with targets

- Quarterly adjustments for income changes or goal shifts

Handling Variable Income

For those with irregular income (freelancers, commission-based workers):

● Calculate baseline income using a 6-12 month average

● Prioritize needs during high-income months

● Build buffer savings for lower-income periods

🔄 Comparing Budgeting Methods

While the 50/30/20 approach works well for many, it’s not the only option:

| Method | Best For | Key Feature |

|---|---|---|

| 50/30/20 Rule | Those seeking balance and simplicity | Percentage-based allocation |

| Zero-Based Budgeting | Detailed financial management | Every dollar assigned a purpose |

| Envelope System | Visual learners and cash users | Physical or digital category limits |

| Pay-Yourself-First | Savings prioritization | Savings allocated before spending |

| 60/30/10 Variation | High-cost areas or lower incomes | Larger needs allocation |

💡 Beyond Basics: Advanced Financial Planning

Debt Management Strategies

● Debt avalanche method: Prioritizing high-interest debts

● Debt snowball method: Paying off smallest balances first for psychological wins

● Refinancing options: potentially lowering interest rates

Investment Integration

● Emergency fund (3-6 months of needs)

● Retirement accounts (401(k), IRA)

● Taxable investment accounts

● Health savings accounts (HSA)

Life Event Planning

● Job changes: Income fluctuations requiring budget recalibration

● Home ownership: Shifting from rent to mortgage and maintenance costs

● Growing family: Adjusting for childcare, education, and larger housing

🚨 Troubleshooting Common Budgeting Challenges

When Percentages Don’t Balance

● Evaluate needs vs. wants: Some expenses may need reclassification

● Consider geographic solutions: Relocation or remote work options

● Income enhancement: Side hustles or skill development

Managing Financial Stress

Start with small adjustments: 5% changes feel more manageable

Celebrate progress: Recognize positive financial behaviors

Seek professional guidance: Financial advisors can provide personalized strategies.

What if my percentages don’t equal 100%?

Our calculator highlights the total percentage, helping you balance your allocations. The goal is exactly 100% distribution.

🔮 The Future of Your Finances

● Flexibility is essential: Life changes require budget adjustments

● Consistency matters: Regular small efforts create significant long-term results

● Progress over perfection: Temporary deviations don’t define financial success