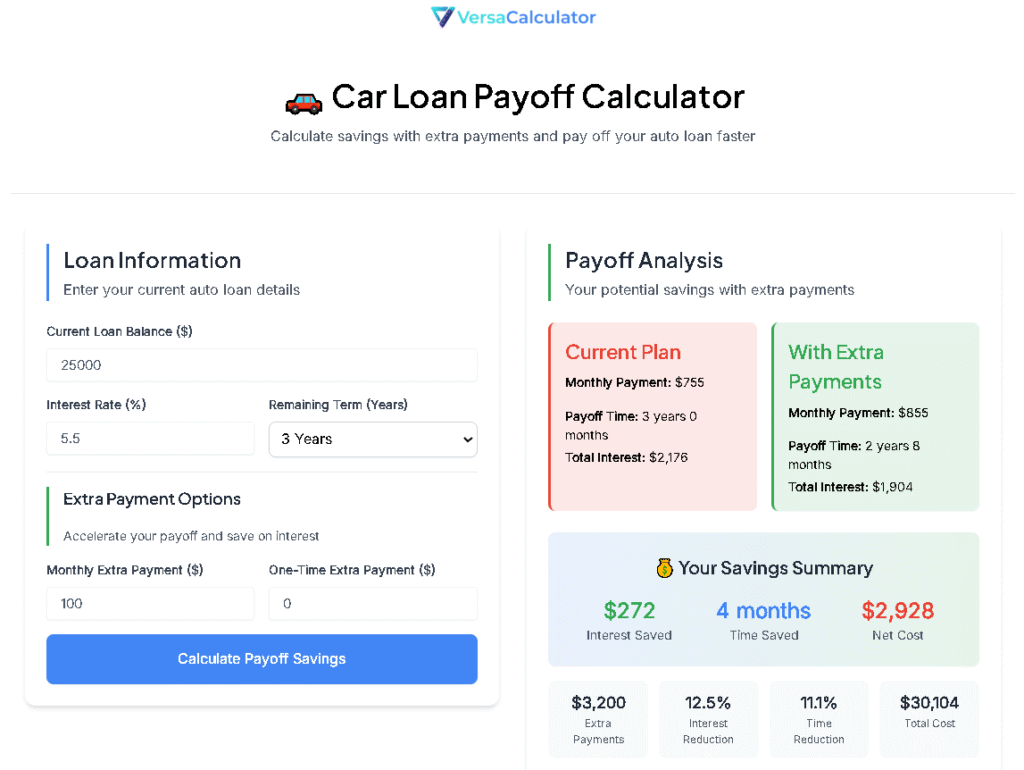

🚗 Car Loan Payoff Calculator

Calculate savings with extra payments and pay off your auto loan faster

Loan Information

Enter your current auto loan details

Extra Payment Options

Accelerate your payoff and save on interest

Payoff Analysis

Your potential savings with extra payments

Click “Calculate Payoff Savings” to see your results

A Car Loan Payoff Calculator is a powerful financial tool that helps borrowers determine how much they can save by making extra payments toward their auto loan. It calculates the impact of additional payments on your loan term and total interest paid, empowering you to make informed decisions about paying off your car loan faster.

Our advanced calculator provides a user-friendly interface that instantly shows how extra payments affect your loan timeline and total interest costs. It allows you to input both monthly extra payments and one-time lump sum payments to give you a complete picture of your payoff strategy.

How to Use Our Car Loan Payoff Calculator

1. Enter Current Loan Balance: Input your remaining principal balance (the amount you still owe on your loan).

2. Input Interest Rate: Enter your annual percentage rate (APR).

3. Select Remaining Term: Choose how many years you have left on your loan term (typically ranging from 1-7 years).

4. Add Extra Payments:

● Monthly Extra Payment: Enter any additional amount you plan to pay each month

● One-Time Payment: Input any lump sum amount you want to apply immediately

5. Click “Calculate Payoff Savings”: Instantly see your interest savings and reduced loan term.

⚙️ How the Calculator Works

Monthly Payment Calculation

● Monthly Payment Calculation: Your standard monthly payment is calculated using the standard amortization formula: Monthly Payment = P × (r × (1 + r)^n) / ((1 + r)^n - 1), where P is the principal, r is the monthly interest rate, and n is the number of payments.

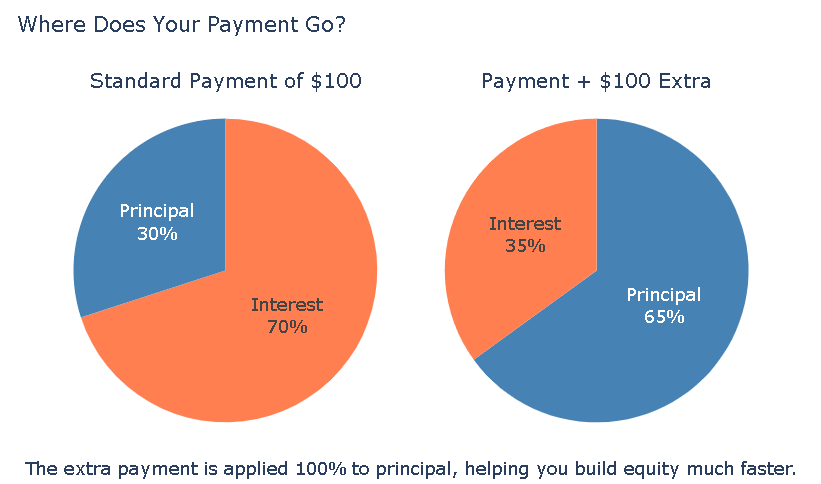

● Extra Payment Application: Additional payments are applied directly to your principal balance. This reduces the amount used to calculate future interest, which shortens your loan term.

● Interest Savings Calculation: The tool compares the total interest paid under your current plan against the total interest paid with extra payments. The difference is your total interest saved.

💰 Benefits of Paying Off Your Car Loan Early

1. Significant Interest Savings

Since auto loans are front-loaded with interest, extra payments that reduce your principal directly lower the amount of future interest you will pay.

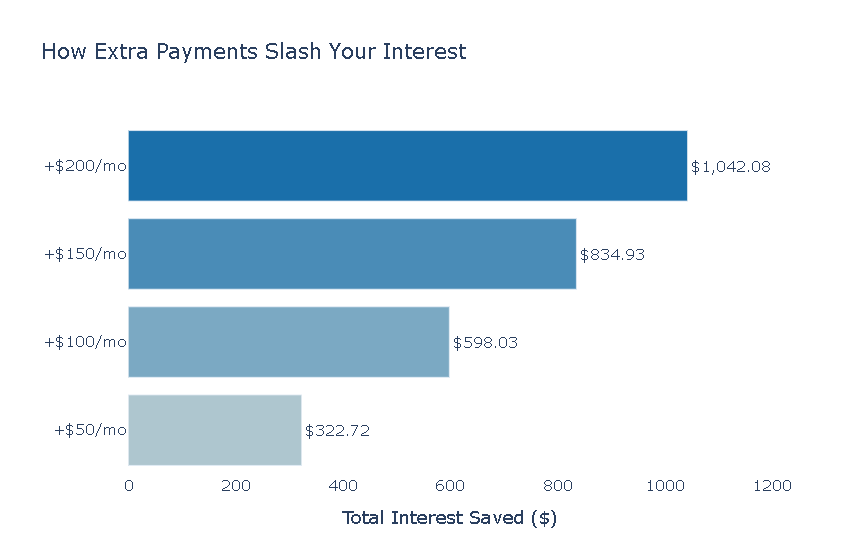

2. Shorter Loan Term

Reducing your principal faster decreases the number of payments required. For example, on a $35,000 loan at 6.7% with 48 months remaining:

| Increased Payment | Term Reduction | Interest Saved |

|---|---|---|

| $50 | 3 months | $322.72 |

| $100 | 6 months | $598.03 |

| $150 | 9 months | $834.93 |

| $200 | 11 months | $1,042.08 |

3. Build Equity Faster

Paying off your loan faster helps you build equity in your vehicle more quickly, which is important as cars depreciate rapidly.

4. Financial Flexibility

Freeing up your monthly cash flow allows you to redirect money toward other financial goals like retirement savings or emergency funds.

5. Avoid Being “Upside Down”

Paying off your loan faster reduces the risk of owing more than the car’s current value.

Important Considerations Before Making Extra Payments

1. Prepayment Penalties

Some lenders charge a fee for paying off your loan early. Always check your loan agreement first.

2. Precomputed Interest Loans

If your loan has precomputed interest, the total interest was calculated upfront, and early payoff may not save you money. Verify your loan type.

3. Higher-Interest Debt Priority

It is often more beneficial to pay off debts with higher interest rates (like credit cards) first.

4. Emergency Fund Priority

Maintain an emergency fund with 3-6 months of living expenses before focusing on extra debt payments.

🔍 Advanced Strategies for Auto Loan Payoff

1. Biweekly Payments

Pay half your monthly payment every two weeks. This results in 26 half-payments per year, equivalent to 13 full monthly payments.

2. Windfall Application

Use tax refunds, bonuses, or gifts as lump-sum payments for an immediate impact.

3. Round-Up Payments

Round your payment up to the nearest $50 or $100. The small increase accelerates payoff over time.

4. Refinancing Consideration

If interest rates have dropped, refinancing to a lower rate can magnify the impact of your additional payments.

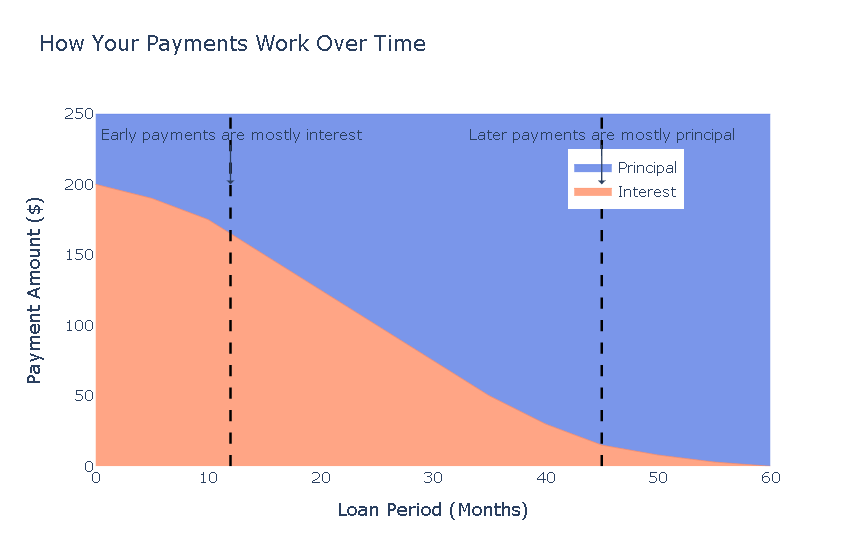

Understanding Your Amortization Schedule

Our calculator generates a detailed amortization schedule that shows how each payment is allocated between principal and interest over time. This schedule illustrates how:

● Early payments apply mostly toward interest

● As the principal balance decreases, more of each payment applies to principal

● Extra payments accelerate this process, reducing the principal faster

Here’s an abbreviated example from a typical auto loan amortization schedule:

| Year | Interest Paid | Principal Paid | Ending Balance |

|---|---|---|---|

| 1 | $1,835.98 | $7,222.21 | $32,777.79 |

| 2 | $1,466.48 | $7,591.71 | $25,186.08 |

| 3 | $1,078.07 | $7,980.12 | $17,205.96 |

| 4 | $669.80 | $8,388.40 | $8,817.56 |

| 5 | $240.63 | $8,817.56 | $0.00 |

FAQ

Will making extra payments always save me money?

A: In most cases, yes. However, savings may be reduced or eliminated if your loan has precomputed interest or prepayment penalties. Always check your loan terms first.

Should I pay off my car loan early or invest the money?

A: This depends on your interest rate. If your auto loan rate is higher than your expected investment return, paying off the debt usually provides a better return. For low-interest loans (below 4-5%), investing may make more sense.

How do I ensure my extra payments are applied correctly?

A: Always specify that extra payments should be applied to principal reduction only, and verify this with your lender. Some may apply them to future interest unless instructed otherwise.

Can I use this calculator for other types of loans?

A: While designed for auto loans, it works for any amortized installment loan with a fixed rate and term, including personal loans.