Internal Rate of Return Calculator

Calculate Internal Rate of Return with Advanced Analytics

Quick Setup

Cash Flow Timeline

Cash Flow Tips

- • Negative values represent cash outflows (investments, costs)

- • Positive values represent cash inflows (returns, profits)

- • Period 0 is typically your initial investment (negative)

- • IRR is the rate that makes NPV = 0

IRR Results

Investment Grade

Benchmark Comparison

Sensitivity Analysis

Cash Flow Visualization

NPV Analysis

Risk Assessment

Enter cash flows to see risk analysis

IRR calculations use the Newton-Raphson method for accuracy. Results are estimates for educational purposes.

What is an IRR Calculator?

An IRR (Internal Rate of Return) Calculator is a financial tool that calculates the annualized rate of return an investment is expected to generate, considering both the magnitude and timing of all cash flows. The IRR represents the discount rate that makes the Net Present Value (NPV) of all cash flows equal to zero, providing investors with a standardized metric to evaluate and compare the profitability of different investments.

Unlike simple return metrics, IRR accounts for the time value of money – recognizing that receiving cash sooner is more valuable than receiving it later. This makes it particularly valuable for evaluating investments with complex cash flow patterns such as real estate projects, private equity investments, business ventures, and capital budgeting decisions.

Our advanced IRR calculator goes beyond basic calculations to provide:

- ● Sensitivity analysis showing how changes in cash flows affect IRR

- ● Benchmark comparisons against standard investment classes

- ● Visualizations of cash flow patterns and cumulative returns

- ● Risk assessment based on cash flow volatility

- ● NPV analysis at multiple discount rates

How to Use Our IRR Calculator

1. Input Your Cash Flows

- ● Initial Investment: Enter your upfront investment as a negative value (e.g., -$100,000).

- ● Subsequent Cash Flows: Add expected annual cash inflows (positive values) or outflows (negative values).

- ● Custom Periods: Add specific cash flows for each year of your investment horizon.

2. Generate Patterned Cash Flows (Optional)

- ● Uniform Cash Flows: Automatically generate consistent annual returns.

- ● Growth Pattern: Create cash flows with a progressive growth rate (e.g., 5% annual increase).

3. Analyze Results

- ● IRR Percentage: Your calculated internal rate of return.

- ● Investment Grade: Quality rating based on your IRR.

- ● Payback Period: Time required to recover your initial investment.

- ● Sensitivity Analysis: How changes affect your returns.

- ● Visual Charts: Graphical representation of cash flows and cumulative returns.

4. Advanced Analysis

- ● NPV Calculation: Compute Net Present Value at different discount rates.

- ● Risk Assessment: Evaluate investment stability based on cash flow patterns.

- ● Benchmark Comparison: Compare your IRR against standard investment classes.

How the IRR Calculator Works

The IRR Formula

The mathematical foundation of IRR is based on the following equation:

NPV = 0 = CF₀ + CF₁/(1+IRR) + CF₂/(1+IRR)² + … + CFₙ/(1+IRR)ⁿ

Where:

- CF₀ = Initial investment (typically negative).

- CF₁ to CFₙ = Cash flows in each period.

- IRR = Internal Rate of Return.

- n = Number of periods.

Since solving this equation algebraically is complex, our calculator uses the Newton-Raphson numerical method to iteratively approximate the IRR with high precision.

Calculation Process

- 1. Cash Flow Organization: The calculator first organizes all cash flows in chronological order.

- 2. Initial Guess: Starts with an initial guess rate (typically 10%).

- 3. Iterative Calculation: Adjusts the rate repeatedly until NPV approaches zero.

- 4. Precision Check: Continues until the solution converges within a tight tolerance (0.000001).

- 5. Validation: Ensures the mathematical validity of the result.

Key Financial Concepts Behind IRR

Time Value of Money

IRR incorporates the fundamental principle that money available today is worth more than the same amount in the future due to its potential earning capacity. This is why earlier cash flows have greater impact on IRR than later ones.

Net Present Value (NPV)

NPV represents the difference between the present value of cash inflows and outflows. IRR is specifically the discount rate where NPV equals zero, representing the break-even rate of return.

Compound Growth

IRR represents the annualized compound growth rate of your investment, assuming all interim cash flows are reinvested at the same rate.

Interpreting Your IRR Results

What is a Good IRR?

- ● >20%: Excellent return (Outperforms most market benchmarks)

- ● 15-20%: Very good return (Strong investment performance)

- ● 10-15%: Good return (Meets market expectations)

- ● 5-10%: Fair return (May warrant considering alternatives)

- ● <5%: Poor return (Likely underperforming relative to risk)

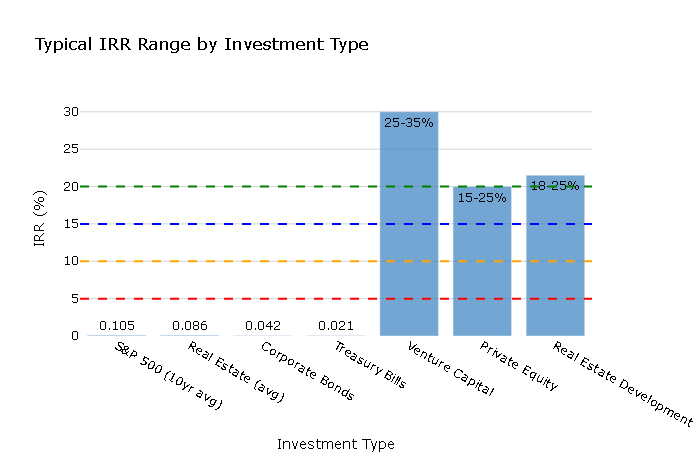

Industry Benchmark Comparisons

Our calculator compares your IRR against standard investment classes:

| Investment Type | Typical IRR Range | Risk Profile |

|---|---|---|

| S&P 500 (10yr avg) | 10.5% | Moderate |

| Real Estate (avg) | 8.6% | Moderate |

| Corporate Bonds | 4.2% | Low |

| Treasury Bills | 2.1% | Very Low |

| Venture Capital | 25-35% | Very High |

| Private Equity | 15-25% | High |

| Real Estate Development | 18-25% | Medium-High |

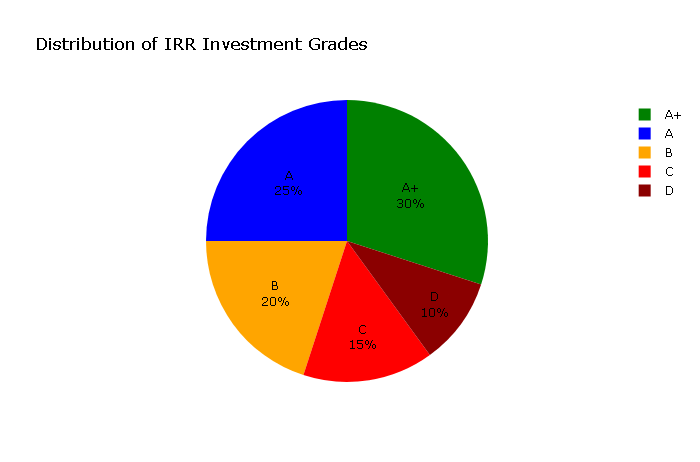

Investment Grade Assessment

Our calculator provides a quality rating based on your calculated IRR:

- ● A+ (Excellent): IRR ≥ 20%

- ● A (Very Good): IRR 15-20%

- ● B (Good): IRR 10-15%

- ● C (Fair): IRR 5-10%

- ● D (Poor): IRR < 5%

Calculation Example

Investment Scenario:

- ● Initial Investment: $100,000

- ● Annual Cash Flows: $25,000 for 5 years

- ● Final Return: $120,000 in year 5.

Calculation Process:

- 1. Year 0: -$100,000 (initial investment)

- 2. Year 1: +$25,000

- 3. Year 2: +$25,000

- 4. Year 3: +$25,000

- 5. Year 4: +$25,000

- 6. Year 5: +$145,000 ($25,000 + $120,000).

IRR Calculation:

The calculator determines that the IRR for this investment is approximately 18.9%.

Interpretation:

This IRR of 18.9% represents a very good return that outperforms most market benchmarks. The investment would be classified as “Very Good (A)” based on our grading scale.

Professional Applications of IRR Calculation

Real Estate Investment

IRR is essential for evaluating rental properties, development projects, and commercial real estate investments where cash flows are irregular and span multiple years.

Business Capital Budgeting

Companies use IRR to evaluate potential projects, acquisitions, and expansion opportunities by comparing expected returns to their cost of capital.

Private Equity and Venture Capital

IRR is the standard metric for measuring performance in private investing, where investments typically involve multiple funding rounds and irregular exit timing.

Personal Investment Planning

Individual investors can use IRR to compare different investment opportunities, from rental properties to business ventures, on a standardized annualized return basis.

FAQ

What’s the difference between IRR and ROI?

ROI (Return on Investment) is a simple percentage calculation of total returns divided by initial investment, without considering the time value of money or cash flow timing. IRR accounts for both the size and timing of all cash flows, providing a more sophisticated annualized return measure.

Can IRR be negative?

Yes, negative IRR occurs when the total cash outflows exceed inflows, indicating a losing investment. This typically happens when an investment loses money overall.

Why does my investment have high IRR but low NPV?

This can occur when a high IRR is generated on a small investment amount. A small project might have a high percentage return but low absolute dollar value. This highlights why both IRR and NPV should be considered together.

What are the limitations of IRR?

While powerful, IRR has some limitations:

- ● Reinvestment assumption: IRR assumes interim cash flows can be reinvested at the same rate, which may not be realistic.

- ● Multiple solutions: Complex cash flow patterns with multiple sign changes can sometimes yield multiple IRR solutions.

- ● Scale ignorance: IRR doesn’t account for the absolute size of the investment.

How is IRR different from compound annual growth rate (CAGR)?

CAGR measures the mean annual growth rate of an investment assuming steady growth, while IRR handles irregular cash flows and accounts for the specific timing of each inflow and outflow.