Debt Snowball Calculator

Choose the best debt payoff strategy and become debt-free faster with our comprehensive calculator

Your Current Debts

Extra Monthly Payment

This amount will be added to your debt payments using your chosen strategy

Total Debt

$0

Min Payments

$0

What is a Debt Snowball Calculator?

A Debt Snowball Calculator is a powerful financial tool that helps you create a strategic plan to eliminate your debts efficiently. It implements the debt snowball method, where you pay off your debts from smallest to largest balance regardless of interest rates, gaining momentum as each balance is eliminated. This approach provides psychological wins that keep you motivated throughout your debt repayment journey.

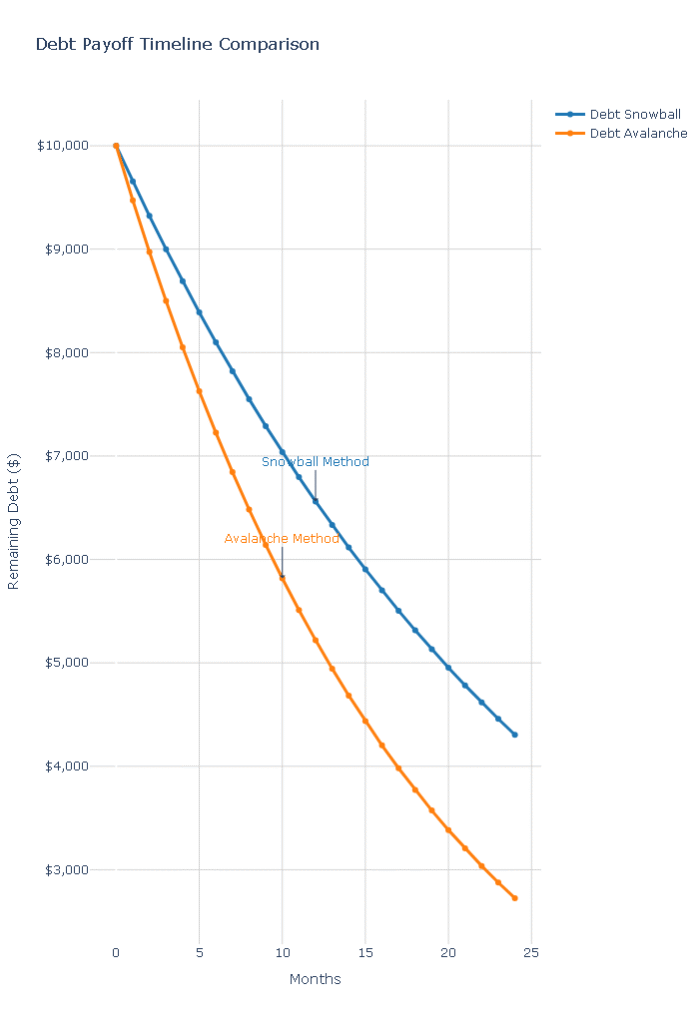

Our advanced calculator goes beyond basic functionality by allowing you to compare the debt snowball method with the debt avalanche approach (which prioritizes higher interest rate debts first). This comprehensive analysis helps you determine which strategy will work best for your specific financial situation and personality.

How to Use Our Debt Snowball Calculator

Step 1: Enter Your Debt Information

- ● List each debt: Include credit cards, personal loans, auto loans, and other non-mortgage debts.

- ● Input details: For each debt, enter the current balance, minimum monthly payment, and annual interest rate.

- ● Add all obligations: Be thorough and include even small debts for accurate calculations.

Step 2: Specify Additional Payment Amount

- ● Determine extra payment: Decide how much extra you can pay toward debt each month beyond minimum payments.

- ● Be realistic: Choose an amount you can consistently maintain without straining your budget.

- ● Consider opportunities: Look for ways to increase this amount through expense reduction or income increases.

Step 3: Analyze Your Results

- ● Review payoff timeline: See when you’ll become debt-free with each method.

- ● Compare strategies: Understand the trade-offs between snowball and avalanche approaches.

- ● Examine payoff order: View the sequence in which your debts will be eliminated.

- ● Calculate interest savings: See how much you’ll save in interest payments.

Step 4: Implement Your Plan

- ● Focus payments: Continue making minimum payments on all debts while putting extra funds toward your first target debt.

- ● Roll over payments: As each debt is paid off, add its payment to your next debt’s payment.

- ● Track progress: Use our calculator regularly to monitor your journey and stay motivated.

⚙️ How the Debt Snowball Calculator Works

The Algorithm Behind the Scenes

- Organizes debts: Sorts your debts either by balance (snowball) or interest rate (avalanche).

- Calculates monthly interest: Applies appropriate interest charges to each debt.

- Applies payments: Distributes your specified payments according to the selected method.

- Rolls over payments: When a debt is eliminated, its payment amount is added to the next debt’s payment.

- Projects timeline: Calculates how long it will take to become completely debt-free.

- Computes interest costs: Determines total interest paid under each approach.

The Mathematical Formula

The calculator uses amortization calculations to determine how each payment affects your principal and interest. The key formula for each debt’s monthly interest calculation is:

Monthly Interest = (Current Balance × Annual Interest Rate) ÷ 12

The payment allocation follows this pattern:

Payment Allocation = Minimum Payment + Extra Payment + Rollover Payments from Paid-off Debts

Debt Snowball vs. Debt Avalanche: Which is Better?

Our calculator allows you to compare both popular debt repayment strategies:

Debt Snowball Method (Pay smallest balances first)

- ● Psychological advantage: Provides quick wins that boost motivation.

- ● Behavioral focus: Addresses debt as a behavior problem rather than a math problem.

- ● Momentum building: Creates increasing payment power as each debt is eliminated.

Debt Avalanche Method (Pay highest interest rates first)

- ● Mathematical advantage: Saves more money on interest payments over time.

- ● Financial efficiency: Pays off debt in the mathematically optimal sequence.

- ● Time efficiency: May result in a faster overall debt payoff in some cases.

Table: Comparison of Debt Repayment Strategies

| Factor | Debt Snowball | Debt Avalanche |

|---|---|---|

| Payment Order | Smallest to largest balance | Highest to lowest interest rate |

| Psychological Benefits | High (quick wins) | Lower (may take longer to see progress) |

| Financial Efficiency | Good (may pay slightly more interest) | Excellent (saves on interest costs) |

| Best For | Those needing motivation | Those focused strictly on numbers |

Strategies to Accelerate Your Debt Payoff

1. Increase Your Payment Amounts

- ●Budget effectively: Use a zero-based budget to identify extra money for debt repayment.

- ● Reduce expenses: Cut discretionary spending temporarily to free up more debt-repayment funds

- ● Increase income: Take on side jobs or sell unused items to generate extra debt-paying money.

2. Implement Rollover Payments Faithfully

- ● Maintain payment levels: When a debt is paid off, apply its entire payment amount to your next debt.

- ● Avoid lifestyle creep: Don’t spend the money freed up from paid-off debts.

- ● Track progress: Use our calculator regularly to see how rollovers accelerate your payoff date.

3. Consider Lump-Sum Payments

- ● Apply windfalls: Use tax refunds, bonuses, or gifts to make extra debt payments.

- ● Calculate impact: Use our calculator to see how lump-sum payments affect your payoff timeline.

- ● Stay consistent: Continue with your regular payments even after making lump-sum payments.

Getting Started with Your Debt Payoff Journey

Preparing Your Debt Information

Before using the calculator, gather:

- ● Recent statements: For all credit cards, loans, and other debts.

- ● Current balances: Exact amounts owed on each debt.

- ● Interest rates: Annual percentage rates (APRs) for each debt.

- ● Minimum payments: Required monthly payments for each debt.

Implementing Your Plan

- ● Automate payments: Set up automatic transfers to ensure consistency

- ● Track progress: Use our calculator monthly to see your remaining timeline

- ● Stay motivated: Remember why you’re pursuing debt freedom and visualize the benefits

Disclaimer: This calculator provides estimates based on the information you provide. Actual results may vary based on interest rate changes, payment timing, and other factors.